The following is a guest post from Ed Burghard. Ed has had a long and distinguished career at Procter & Gamble where he was named a Harley Procter Marketing Director, the highest honor for a P&G marketer. He retired from P&G and now dedicates his time to his passions including his wife, his fitness, and www.StrengtheningBrandAmerica.com. Enjoy his guest post and feel free to comment below.

As Ed says, we can’t necessarily project this data beyond it’s original study population, however, as someone who retired at age 46 — it looks pretty good to me!

If you would like to submit a guest post, please use the Contact page to submit or inquire. Enjoy… MyLife2.0

+ + + + + + + + + + + + + + +

In an earlier post I shared my thoughts on how big your nut needed to be in order to retire comfortably (“How Big is Your Nut?”). In this post, I want to take a look at the question of at what age should you retire. We’ll make the assumption your nut is big enough.

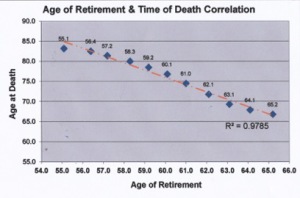

As I was trying to answer the age question for myself, a good friend shared the results of an actuarial analysis conducted by Dr. Ephrem Chung on data from Boeing Aerospace. In 2002, Dr. Sing Lin authored a paper entitled “Optimum Strategies for Creativity and Longevity” and shared conclusions based on these data. In that paper, he concludes “people who take early retirements at the age of 55 tend to live long and well into their 80s and beyond.”

In all fairness, the appropriateness of projecting these data beyond the specific study populations has been challenged. But, not withstanding, I think they give cause to pause. At least they made me stop and take a critical look at the question of at what age I should retire. The prospect of cutting my life short because I continued to work past age 55 was sobering.

As I thought about why work might shorten your life, I concluded the cause was likely stress related. For many people, they find themselves at the zenith of their career by age 55. As a consequence, their salary bumps up against the cap for their level and the only way management can justify continuing to pay a high salary is through increasing the workload.

Ultimately the situation is a self-fulfilling prophecy. When the workload approaches (or exceeds) capacity stress levels increase. Dissatisfaction from being put in a position where your performance suffers, leads to self-criticism and loss of identity/purpose at work. This stress takes a toll that leads to a shortening of your life span.

The famous playwright George Bernard Shaw once said – “We don’t stop playing because we grow old; we grow old because we stop playing.” I think for many of us that risk is real.

The famous playwright George Bernard Shaw once said – “We don’t stop playing because we grow old; we grow old because we stop playing.” I think for many of us that risk is real.

You will need to self assess your work situation and decide if the factors that lead to above normal stress exist. If they do, then it may make sense for you to decide to retire as early as your nut allows in order to maximize your longevity.

In my case, I concluded that I wanted to step away from full time work sooner rather than later and retired at age 57. I didn’t step away from work altogether. Instead, I created the www.strengtheningbrandamerica.com website to help share my professional knowledge with others. But, now I work on my own time and for my pleasure rather than because I have to. The choice also allowed me time to build a daily workout into my life and as a result, I have lost 50 pounds (which I know has positively contributed to the probability of increased longevity).

Again, the study data are by no means conclusive. If you retire early it is not a guarantee of a longer life. In fact, if your nut isn’t big enough and you worry every day about running out of money, you might actually create enough stress to shorten your life span.

But, I do recommend you at least look at the Boeing Aerospace actuarial data as one piece of the puzzle when deciding the right time to retire.

Ed Burghard